A "vector" version of the model with an application to the economic analysis of alternative aid packages can be found here.

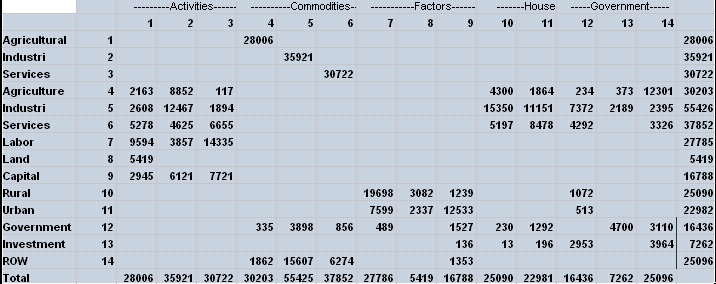

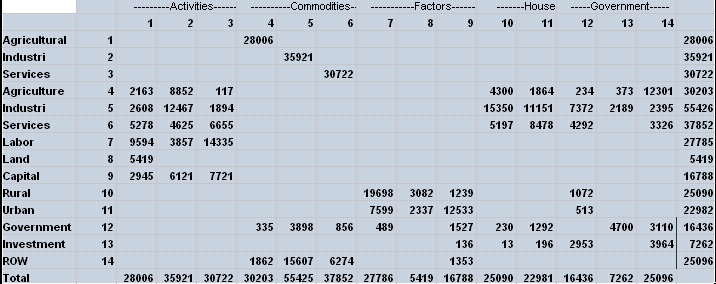

$MODEL:SOE $SECTORS: Y.AGR ! Domestic production - AGR Y.IND ! Domestic production - IND Y.SER ! Domestic production - SER A.AGR ! Armington aggregate - AGR A.IND ! Armington aggregate - IND A.SER ! Armington aggregate - SER C.RURAL ! Household consumption - RURAL C.URBAN ! Household consumption - URBAN INVEST ! Investment $COMMODITIES: PD.AGR ! Domestic output price - AGR PD.IND ! Domestic output price - IND PD.SER ! Domestic output price - SER PA.AGR ! Armington aggregate price - AGR PA.IND ! Armington aggregate price - IND PA.SER ! Armington aggregate price - SER PC.RURAL ! Consumption price index - RURAL PC.URBAN ! Consumption price index - URBAN PF.L ! Factor price - LABOR PF.N ! Factor price - LAND PF.K ! Factor price - CAPITAL PINV ! Unit cost of new capital PFX ! Real exchange rate $CONSUMERS: RA.RURAL ! Income - RURAL households RA.URBAN ! Income - URBAN households GOVT ! Value of government expenditure FDI ! Level of foreign investment * Production functions combine intermediate inputs * with value-added in fixed proportions. Value-added * is a Cobb-Douglas aggregate of primary factors (labor, * land and capital -- land only enters sector AGR). * Output is produced for sale in the domestic and foreign * markets according to a constant elasticity of * transformation. Production for the export market is * subject to a 15% tax in the benchmark, so the reference * price of exports is 0.85 = 1-0.15 (Taxes on production * outputs are defined on a gross basis, so the benchmark * taxes decrease the reference price of output): * The export tax rate is computed as * tx = 3110/(3110+12301+2395+3326) * The FOB export value for AGR, gross of tax is 14424. * This is computed as 12301/(1-tx). $PROD:Y.AGR S:0 T:4 VA: 1 O:PFX Q: 14424 P:0.85 A:GOVT T:0.15 O:PD.AGR Q: 15705 I:PA.AGR Q: 2163 I:PA.IND Q: 2608 I:PA.SER Q: 5278 I:PF.L Q: 9594 VA: I:PF.N Q: 5419 VA: I:PF.K Q: 2945 VA: $PROD:Y.IND T: 4 VA: 1 O:PFX Q: 2808 P:0.85 A:GOVT T:0.15 O:PD.IND Q: 33526 I:PA.AGR Q: 8852 I:PA.IND Q: 12467 I:PA.SER Q: 4625 I:PF.L Q: 3857 VA: I:PF.K Q: 6121 VA: $PROD:Y.SER T: 4 VA: 1 O:PFX Q: 3900 P:0.85 A:GOVT T:0.15 O:PD.SER Q: 27396 I:PA.AGR Q: 117 I:PA.IND Q: 1894 I:PA.SER Q: 6655 I:PF.L Q: 14335 VA: I:PF.K Q: 7721 VA: * Armington aggregations of domestic and foreign * goods. Imports are represented as a demand for * foreign exchange. Benchmark tariff rates of 18% for * agricultural goods, 25% for industrial goods and * 14% for services. The reference price of imports * reflects these tariffs (taxes on inputs are defined * on a net basis, so the tax increases the reference * input price): * The import tariff rate for AGR is computed as * 335/1862. $PROD:A.AGR S:2 O:PA.AGR Q: 17903 I:PD.AGR Q: 15705 I:PFX Q: 1862 P: 1.18 A:GOVT T:0.18 * The import tariff rate for IND is computed as * 3898/15607 $PROD:A.IND S:2 O:PA.IND Q: 53031 I:PD.IND Q: 33526 I:PFX Q: 15607 P: 1.25 A:GOVT T:0.25 * The import tariff rate for SER is computed as * 856/6274. $PROD:A.SER S:2 O:PA.SER Q: 34526 I:PD.SER Q: 27396 I:PFX Q: 6274 P: 1.14 A:GOVT T:0.14 * Investment combines domestic goods to produce new * vintage capital in the PINV market. There is a * 60% tax on this activity (representing the value of * 4700 in SAM(14,13). In spite of the benchmark tax * we can omit a reference price because there is only a * single output -- reference prices are used to define * the marginal rates of substitution or transformation, * and therefore are required only when there are multiple * inputs or outputs. * The output tax rate for INVEST is computed on a * gross basis as 4700/7262: $PROD:INVEST O:PINV Q: 7262 A:GOVT T:0.6 I:PA.AGR Q: 373 I:PA.IND Q: 2189 * Cobb-Douglas utility function: $PROD:C.RURAL S:1 O:PC.RURAL Q: 24847 I:PA.AGR Q: 4300 I:PA.IND Q: 15350 I:PA.SER Q: 5197 $PROD:C.URBAN S:1 O:PC.URBAN Q: 21494 I:PA.AGR Q: 1864 I:PA.IND Q: 11151 I:PA.SER Q: 8478 $DEMAND:RA.RURAL D:PC.RURAL E:PINV Q:-13 * The following endowment represents transfers * from the government less income tax payments: E:PC.RURAL Q:(1072-230) * Primary factor endowments: E:PF.L Q: 19698 E:PF.N Q: 3082 E:PF.K Q: 1239 $DEMAND:RA.URBAN D:PC.URBAN E:PINV Q:-196 * The following endowment represents transfers * from the government less income tax payments: E:PC.URBAN Q:(513-1292) * Primary factor endowments: E:PF.L Q: 7599 E:PF.N Q: 2337 E:PF.K Q: 12533 $DEMAND:GOVT D:PA.AGR Q: 234 D:PA.IND Q: 7372 D:PA.SER Q: 4292 * These entries correspond to income tax receipts * less transfers for each of the households: E:PC.RURAL Q:(230-1072) E:PC.URBAN Q:(1292-513) * Government investment demand represents government * savings and depreciation: E:PINV Q:(-2953-136) * Government "labor endowment" is a lump-sum tax * on wage income -- if this were a larger number, it * might be more appropriate to represent it as a * distortionary tax: E:PF.L Q: 489 * Government "capital endowment" represents a lump-sum * tax on capital income and depreciation: * E:PF.K Q:(1527+136) $DEMAND:FDI E:PFX Q: (3964-1353) E:PF.K Q:1353 D:PINV Q:3964